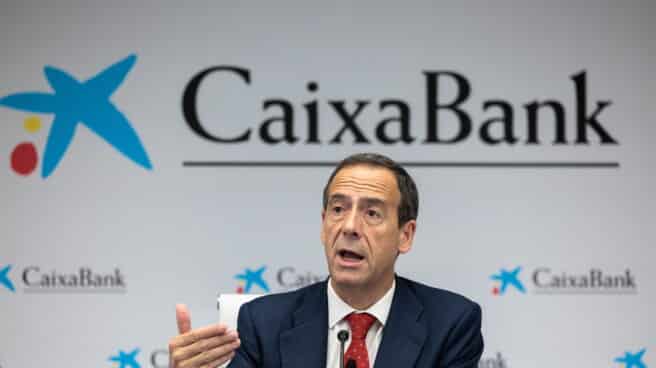

CaixaBank CEO Gonzalo Cortazar announces financial results

CaixaBank earned €3.659 million through September, up 48.2% from a year ago. This increase in profit was due to an improvement in interest margins, which increased by 60.7% to €7.364 million due to higher rates. In the first nine months of the year, revenue growth was 34.3%, amounting to 11.128 million euros.

The company’s CEO, Gonzalo Gortazar, emphasized that “this result allows us to increase our return on equity after many years of low profitability. Without a doubt, this is great news for our more than 600,000 shareholders, in particular for the “la Caixa” Fund and FROB, who will receive higher dividends.

The Group undertakes to distribute between 50% and 60% of profits to its shareholders. In addition, the company intends to distribute 9 billion euros to shareholders between 2022 and 2024. If earnings increase in the last quarter at more or less the rate they had in those quarters, annual earnings would be close to 5,000 million annually, which could mean a distribution of about 2,500 million.

The dynamics of this item, together with the result of insurance services (+21.2%) and income from bank insurance objects (+47.6%), compensated for the fall in the item of net commissions (-5.3%). In particular, regular bank fees were reduced by 9.1% year on year due to the elimination of deposit fees from large companies and bonuses applied to customer loyalty programs.

The positive dynamics of the income statement allows the Group to achieve a profitability (ROE) of 11.9%. In addition, the recurring efficiency ratio (not including extraordinary expenses) improved during this period and decreased again to 42.6%.

In the first nine months, the Catalan enterprise increased customer loyalty to 71.4%, up from 70.4% at the end of last year.

CaixaBank’s loan portfolio also decreased by 1.7%, spending 345-388 million euros. The company explains that the evolution of its business and consumer portfolio offset lower home equity lending, which reduced its portfolio by 3.9% for the year due to depreciation, as well as a year-over-year decline in output amid rising interest rates.

In particular, from January to September the output of new mortgages amounted to 6.680 million euros, in the case of consumption – 7.700 million euros, and in companies – 27.700 million euros.

Despite the growth in consumer lending, the level of overdue debt is 2.7% and remains stable this year. Doubtful balances decrease to EUR 10.2 billion following good performance in asset quality indicators following a decline of EUR 490 million for the year.

In addition, the Group has a robust coverage ratio that increases to 76% (74% at end-2022) and a cost of risk over the last 12 months of 0.3%. Likewise, the insolvency fund closed in September at €7.725 million, of which almost €1.100 million corresponded to undistributed reserves.

Customer funds as of September 30 amounted to EUR 619.323 million (+1.3% year-on-year), supported by the conclusion of contracts for long-term savings products. In this sense, assets under management amount to €155.264 million (+5% year-on-year), driven by positive net subscriptions to investment funds and portfolios.

From January to September, net subscriptions to long-term savings – funds, plans and insurance reach €5.689 million, almost double the figure for the same period in 2022 (€2.952 million). Thus, the combined share of deposits and long-term savings in Spain increases to 26.4%.

On the other hand, the company continues to maintain high levels of both liquidity and capital. Total liquid assets amount to €153.813 million, representing an increase of €14.803 million over the year. Additionally, the group’s liquidity coverage ratio (LCR) stands at 205% as at September 30, demonstrating a comfortable liquidity position well above the required minimum of 100%.

On the capital side, the Common Equity Tier 1 (CET1) ratio is 12.3%, which is above regulatory requirements, following the extraordinary impact of the first application of IFRS 17 accounting rules (-20 basis points) and the distribution of the maximum amount allowed. a new share buyback program launched in September worth €500 million (-23 basis points). The good dynamics of organic capital generation for the first nine months (+162 basis points) stands out.

Code of Best Practice

This year, CaixaBank has facilitated more than 250,000 financial transactions; and approximately 6,000 requests are processed from customers who have requested compliance with the Code of Fair Mortgage Practice. In addition, since the start of the rate increase, about 10,600 refinancing agreements for individuals and 9,800 innovations from floating to fixed rates have been concluded.

Source: El Independiente